Admission of a new partner 12 th class YouTube

Chapter No. 5 - Admission of a Partner - Solution - Class 12 - Tutor's Tips Book Solutions Class +1 - Accountancy Usha Publication Book's Solution - PSEB Unimax Publications Book's Solution - PSEB D K Goel Book's Solution - ISC T.S. Grewal's Book's Solution - CBSE Class +2 - Accountancy Usha Publication - Part I - Solution

Admission of a Partner Class 12 Revision Notes Leverage Edu

Previous Video: https://www.youtube.com/watch?v=N1Q8ZLDwpKcNext Video: https://www.youtube.com/watch?v=nW74UK4yVYw ️📚👉 Get All Subjects playlists:- https:.

!ADJUSTMENT OF CAPITAL! Admission of a Partner. class 12. YouTube

Q. 66 Solution of Chapter 5 Admission of Partner Accountancy Class 12 TS Grewal Book 2021-22. Are you looking for the solution to Question number 66 of the Admission of partner chapter 5 of TS Grewal Book 2021-22 Edition for the 2021-22 session? Question number 66 of chapter 5 of Admission of a partner chapter is a practical one.

Adjustment of Capital Unsolved QA Admission of a Partner Ch 5 Class 12

GSEB Solutions Class 12 Accounts Part 1 Chapter 5 Admission of a Partner April 23, 2023 / By Bhagya / Class 12 Gujarat Board GSEB Textbook Solutions Class 12 Commerce Accounts Part 1 Chapter 5 Admission of a Partner Textbook Exercise Questions and Answers. Gujarat Board Textbook Solutions Class 12 Accounts Part 1 Chapter 5 Admission of a Partner

Class 12 Introduction Admission of Partner Ep. 1 YouTube

TS Grewal Accountancy Class 12 Solutions Chapter 5 - Admission of a partner is considered to be an essential concept to be learnt completely by the students. Here, we have provided TS Grewal Accountancy solutions for class 12 in a simple and a step by step manner, which is helpful for the students to score well in their upcoming board examinations.

Admission of Partner Class 12th Day12 YouTube

Chapter 1- Company Accounts Financial Statements of Not-for-Profit Organisations. Chapter 2- Accounting for Partnership Firms- Fundamentals. Chapter 3- Goodwill- Nature and Valuation. Chapter 4- Change in Profit - Sharing Ratio Among the Existing Partners. Chapter 5- Admission of a Partner. Chapter 6- Retirement/Death of a Partner.

Class 12 Admission of a partner👬 part iii YouTube

Solution: Question 12. A, B, C and D are in partnership sharing profits and losses in the ratio 36:24:20:20 respectively. E joins the partnership for 20% share and A, B, C and DS in future would share profits among themselves as 3/10:4/10: 2/10:1/10. Calculate new profit- sharing ratio after E's admission.

Admission of a new partner Class 12 ISC and CBSE important 2023

When a new partner joins an existing partnership, it is termed as the 'Admission of a Partner'. The entry of a new partner brings about various changes in the profit-sharing ratio, capital, and assets of the partnership firm. TS Grewal Class 12 Chapter 5 delves deep into understanding these changes. New Profit Sharing Ratio (PSR)

Admission of Partner Class 12 Handwritten Notes PDF

Are You looking for the solutions of chapter 5 Admission of Partner of TS Grewal Book Class 12 Accountancy 2022-23 Edition CBSE Board? I have solved each and every question of the 5th chapter of TS Grewal Book of latest 2022-23 Editon for CBSE Board. The link to All unsolved questions has been given below.

Admission of Partner Class 12/ 3rd lecture Ratio Explained YouTube

The 12th standard accountancy is divided into three different books: partnership, companies, and management accounting concepts. The partnerships book carries the most weightage and teaches many important aspects of accounting principles in a partnership firm.

Class 12 Accounts Ch 5 Admission of partner class 12 accounts ch 5 Std 12 Ac Ch 5 Class

June 20, 2022. T.S Grewal Solutions (12) 7. Share your love. Are You looking for the solutions of chapter 5 Admission of Partner of TS Grewal Book Class 12 Accountancy Book 2021-22 Edition? I have solved each and every question of the 5th chapter of TS Grewal Book of latest 2021-22 Editon. The link to All unsolved questions has been given below.

Admission of a Partner Class 12 Introduction Chapter 5 CA Foundation Part 1 YouTube

Available here are Chapter 5 - Admission of a Partner Exercises Questions with Solutions and detail explanation for your practice before the examination. CBSE Commerce (English Medium) Class 12. Question. Get the free view of Chapter 5, Admission of a Partner Class 12 Accountancy - Double Entry Book Keeping Volume 1 additional questions for.

Admission_of_a_Partner_class_12 Account Ch 5 GSEB ENGLISH MEDIUM illustration 18 YouTube

The Indian Partnership Act, 1932 mandates the approval of the existing partners when a new partner is admitted. TS Grewal accountancy class 12 chapter 5 solutions 2023 provides more insight on the subject. Admission of a partner class 12 TS Grewal Solutions 2023 effectively answers all common questions on this topic. 2.

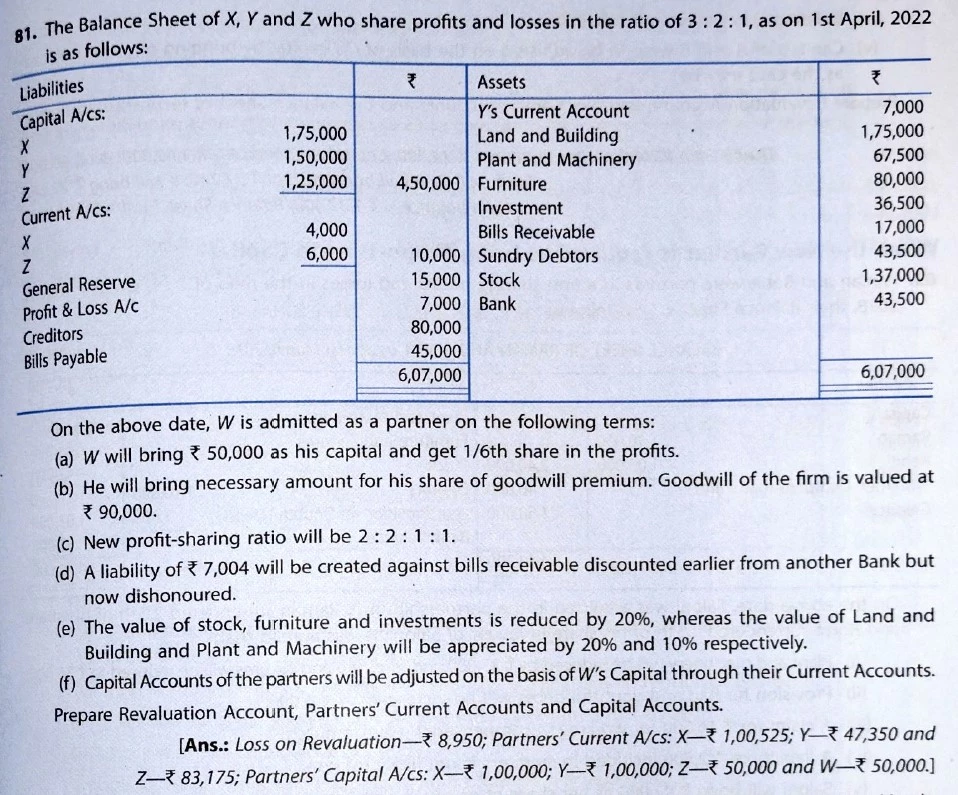

[CBSE] Q. 81 Solution of Admission of Partner TS Grewal Accounts Class 12 (202223)

Ts Grewal Solutions Chapter 5 - Admission of a Partner. Ts Grewal 2019 Solutions for Class 12 Chapter 5 Admission of a partner are provided here. All questions and Solutions from the Double Entry Book Keeping Ts Grewal 2019 Book of Class 12 Accountancy Chapter 5 Admission of a partner are provided here for you for free.

XII class ch5 (Admission of a partner) YouTube

TS Grewal Solutions for Class 12 Accountancy Chapter 5 - Admission of a partner is considered to be an essential concept to be learnt completely by the students. Here, we have provided TS Grewal Accountancy solutions for class 12 in a simple and a step by step manner, which is helpful for the students to score well in their upcoming board.

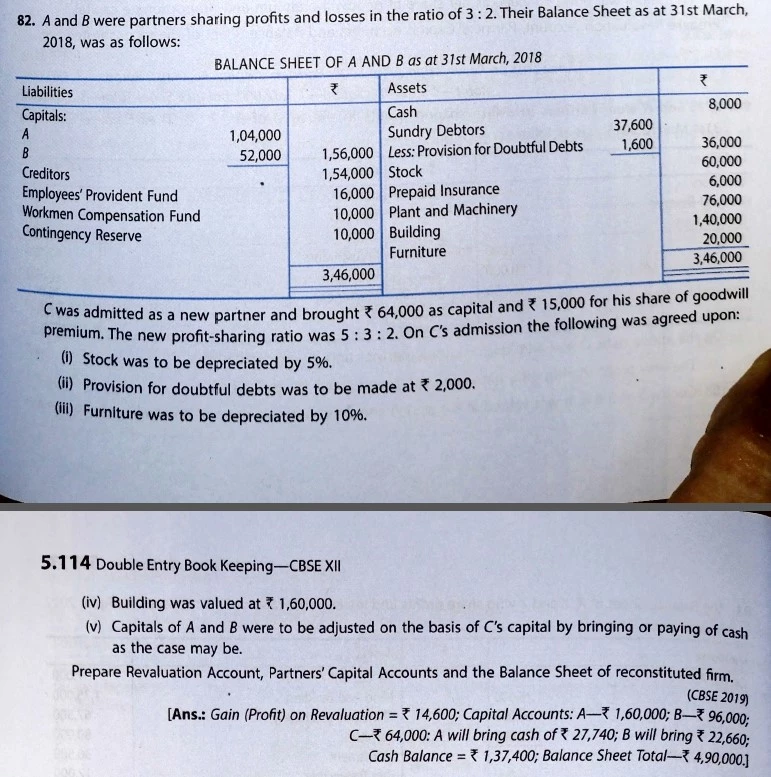

[CBSE] Q. 82 Solution of Admission of Partner TS Grewal Accounts Class 12 (202223)

Define admission of partners. Answer: Admission of a partner is a mode of reconstituting the firm because, with the admission of a partner, the existing agreement ends and new agreement among all the partners comes into force. QUESTION 2 According to section 31 of the Indian Partnership Act, 1932, when can a person be admitted as a new partner?